Market Overview

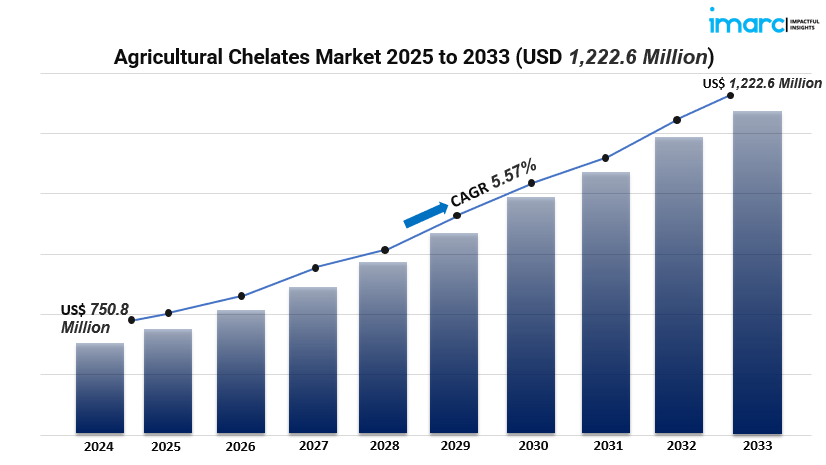

The global agricultural chelates market reached a value of USD 750.8 million in 2024 and is expected to grow to USD 1,222.6 million by 2033, registering a CAGR of 5.57% from 2025 to 2033. This growth is fueled by the rising demand for high-efficiency fertilizers, increasing awareness of sustainable farming practices, and ongoing advancements in chelation technology. Additionally, supportive government policies and the need to meet the food demands of a growing global population are driving the adoption of more effective nutrient delivery solutions in agriculture.

Study Assumption Years

- Base Year: 2024

- Historical Year: 2019–2024

- Forecast Year: 2025–2033

Agricultural Chelates Market Key Takeaways

- Market Size & Growth: The market size reached USD 750.8 million in 2024 and is expected to grow to USD 1,222.6 million by 2033, with a CAGR of 5.57%.

- Dominant Region: Asia Pacific leads the market, driven by a rapidly growing agricultural sector and favorable government initiatives.

- Synthetic Chelates: Synthetic chelates, particularly EDTA, dominate the market due to their stability and cost-effectiveness.

- Foliar Application: The foliar application segment holds the largest market share, offering efficient nutrient delivery.

- Crop Type: Grains and cereals account for the largest share, emphasizing their importance in global food security.

- Technological Advancements: Significant innovations in chelation chemistry enhance nutrient availability and absorption.

- Sustainable Practices: Growing adoption of sustainable agricultural practices boosts the demand for agricultural chelates.

Market Growth Factors

- Increased Adoption of High-Performance Fertilizers

The global agricultural industry is under increasing pressure to improve crop yields and quality, driven by rapid population growth and limited arable land. To meet this demand, high-efficiency fertilizers—particularly chelates—are playing a vital role. Chelated fertilizers enhance the availability and uptake of key micronutrients like zinc, manganese, and iron, which are essential for healthy plant development. Unlike traditional fertilizers, chelates minimize nutrient loss from volatilization, leaching, and soil fixation. This not only boosts crop productivity but also reduces environmental impact, making them a smarter, more sustainable choice for modern farming.

- Breakthroughs in Chelation Chemistry Technology

Recent advancements in chelation chemistry have introduced more efficient and stable chelating agents. Innovations such as biodegradable chelates and crop- or soil-specific formulations significantly improve nutrient availability and uptake. These developments not only boost crop yields and enhance produce quality but also align with the rising demand for sustainable agriculture by minimizing environmental impact.

- Empowering Green Farming: Government’s Role in Sustainability

Governments worldwide are introducing supportive policies and initiatives to advance sustainable agriculture. These measures include subsidies for efficient nutrient delivery systems, grants for R&D in innovative agricultural technologies, and regulations promoting eco-friendly inputs. Such efforts play a vital role in driving the growth of the agricultural chelates market by making advanced nutrient solutions more accessible to farmers and encouraging the adoption of sustainable farming practices.

Request for a sample copy of this report: https://www.imarcgroup.com/agricultural-chelates-market/requestsample

Market Segmentation

- Breakup by Type:

- Synthetic:

- EDTA (Ethylenediaminetetraacetic Acid): Widely used for its stability and effectiveness in various soil conditions.

- EDDHA (Ethylenediamine-N,N’-bis (2-Hydroxyphenylacetic Acid)): Preferred for alkaline soils due to its superior performance.

- DTPA (Diethylenetriamine Pentaacetate): Effective in slightly alkaline to neutral soils.

- IDHA (Imidodisuccinic Acid): Emerging chelate with environmental benefits.

- Others: Includes HEDP, HETDA, organic acids, and NTA.

- Organic:

- Lignosulfonates: Derived from wood pulp, offering biodegradable properties.

- Amino Acids: Enhance plant growth and stress resistance.

- Heptagluconates: Known for their high stability and effectiveness.

- Others: Includes various natural chelating agents.

- Synthetic:

- Breakup by Crop Type:

- Grains and Cereals: Dominant segment, including rice, wheat, and corn.

- Pulses and Oilseeds: Important for protein and oil production.

- Commercial Crops: Includes cotton and tobacco.

- Fruits and Vegetables: High-value crops with significant market demand.

- Turf and Ornamentals: Niche market focusing on aesthetics and landscaping.

- Breakup by Application:

- Soil: Direct application to soil to enhance nutrient availability.

- Foliar: Application to plant leaves for rapid nutrient uptake.

- Fertigation: Integration of fertilizers into irrigation systems.

- Others: Includes seed treatment and trunk injection.

- Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

The Asia Pacific region emerged as a frontrunner in the agricultural chelates market, accounting for a significant 37.4% revenue share in 2023. This strong performance is driven by a growing population and the urgent need to boost agricultural productivity to meet escalating food demands. Farmers across the region are increasingly turning to modern farming practices, including the use of chelates, to combat micronutrient deficiencies and support healthier, more robust plant growth.

Recent Developments & News

- ICL Group’s Biodegradable Chelate: In July 2023, ICL Group introduced a biodegradable chelate with demonstrated bioactivity. This innovative technology not only delivers an average yield increase of 2.5 bags per hectare in soybean cultivation, compared to traditional chelating agents, but also ensures biodegradability in the soil and exhibits a notable physiological effect.

- Nouryon’s Acquisition of ADOB: In January 2023, Nouryon, a global leader in specialty chemicals, acquired ADOB, a major supplier of chelated micronutrients, fertilizers, and specialized agricultural solutions in Poland. This strategic acquisition enhances Nouryon’s diverse crop nutrition portfolio and reinforces its commitment to the agriculture and food sector, allowing the company to expand its range of services and products for industry customers.

- Croplands and Robotics Plus Partnership: In March 2024, Croplands and Robotics Plus partnered to launch Prospr, an innovative spray equipment platform, into the horticulture sector in Australia and New Zealand. This collaboration aims to enhance the efficiency and effectiveness of pesticide and fertilizer applications in horticultural crops.

Key Players

- Akzo Nobel N.V.

- Aries Agro Ltd

- BASF SE

- Dow Inc.

- Haifa Negev Technologies Ltd.

- Mitsubishi Chemical Corporation

- Nouryon

- Nufarm Limited

- Protex International SA

- The Andersons Inc

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5596&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145