Market Overview

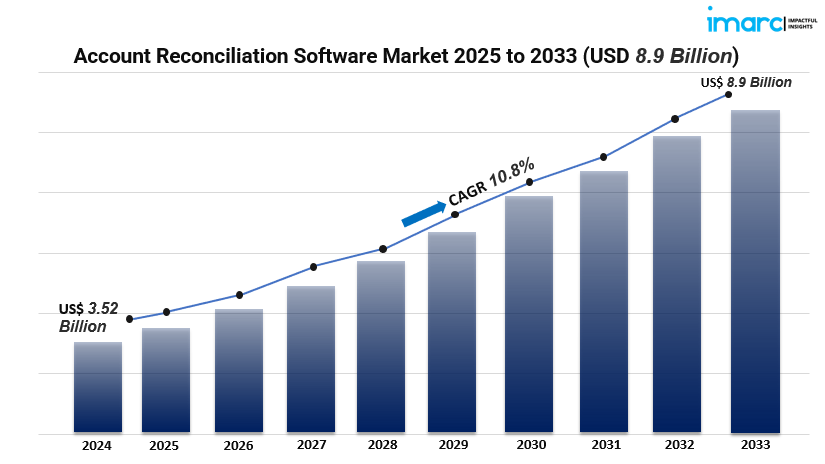

The global account reconciliation software market is poised for significant growth, projected to expand from USD 3.52 billion in 2024 to USD 8.9 billion by 2033, reflecting a robust CAGR of 10.8% during the forecast period. This growth is driven by the increasing demand for automation in financial operations, heightened compliance requirements, and the need to minimize human errors. Organizations are seeking efficient, real-time financial reporting and greater transparency, leading to the adoption of cloud-based solutions and integration with ERP systems. The market’s expansion is further supported by the widespread adoption of customer-centric banking solutions and the escalating demand for automated banking solutions and error detection software to enhance operational efficiency and reduce overall costs.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019–2024

- Forecast Years: 2025–2033

Account Reconciliation Software Market Key Takeaways

- Market Size and Growth: Valued at USD 3.52 billion in 2024, the market is expected to reach USD 8.9 billion by 2033, growing at a CAGR of 10.8% during 2025–2033.

- Technological Advancements: Integration of AI and ML enhances capabilities, improving cash flow management and reconciliation processes.

- Regulatory Compliance: Increasing regulatory requirements drive the adoption of automated reconciliation solutions to ensure compliance.

- Operational Efficiency: Organizations leverage these tools to streamline financial processes, reduce manual errors, and improve accuracy.

- Market Expansion: The market is expanding across various sectors, including BFSI, manufacturing, retail, healthcare, IT and telecom, energy and utilities, and government.

- Regional Dominance: North America currently dominates the market, holding a significant market share due to early adoption of advanced financial technologies and a favorable regulatory environment.

Market Growth Factors

1. Technological Advancements

The world of account reconciliation software is undergoing a major transformation thanks to cutting-edge technologies like artificial intelligence (AI) and machine learning (ML). These innovations are supercharging reconciliation software by automating data matching, spotting discrepancies, and offering predictive insights. With AI and ML in the mix, organizations can enhance their cash flow management and streamline reconciliation processes, resulting in greater efficiency and accuracy. As companies look to harness these technological breakthroughs, the demand for advanced reconciliation tools is set to soar, fueling market expansion.

2. Regulatory Compliance

In today’s fast-changing regulatory environment, accurate and timely financial reporting is more important than ever. Account reconciliation software is essential for ensuring compliance, as it automates the creation of verified financial data, significantly reducing the risk of falling out of line with regulations. More and more organizations are turning to these solutions to meet strict regulatory demands, which is driving the growth of the account reconciliation software market.

3. Operational Efficiency

Organizations are on a mission to boost operational efficiency by refining financial processes and cutting down on manual errors. Account reconciliation software plays a key role in this effort by automating everyday tasks, freeing up resources for more strategic initiatives. By adopting these tools, businesses can achieve better accuracy, lower operational costs, and increased productivity. As the focus on operational efficiency continues to rise, the demand for account reconciliation software is expected to see significant growth.

Request for a sample copy of this report: https://www.imarcgroup.com/account-reconciliation-software-market/requestsample

Market Segmentation

By Component

- Software: Standalone applications designed to automate and streamline the reconciliation process, offering features such as transaction matching, reporting, and issue management.

- Services: Professional services including implementation, support, and maintenance that complement the software solutions and ensure optimal performance.

By Deployment Mode

- On-premises: Solutions installed and operated on the organization’s internal servers, offering greater control and security over data.

- Cloud-based: Web-based solutions hosted on remote servers, providing scalability, flexibility, and reduced maintenance costs.

By Organization Size

- Small and Medium-sized Enterprises: Organizations with limited resources seeking cost-effective and scalable reconciliation solutions to improve financial accuracy.

- Large Enterprises: Organizations with complex financial operations requiring robust and customizable reconciliation software to manage high volumes of transactions.

By End User

- BFSI: Banks, financial services, and insurance companies utilizing reconciliation software to manage vast financial transactions and ensure regulatory compliance.

- Manufacturing: Companies employing reconciliation tools to manage complex supply chains and financial operations.

- Retail and E-Commerce: Businesses using reconciliation software to handle high volumes of transactions and prevent errors.

- Healthcare: Healthcare providers adopting reconciliation solutions to manage financial data and comply with industry regulations.

- IT and Telecom: Organizations leveraging reconciliation software to manage financial operations and ensure data accuracy.

- Energy and Utilities: Companies utilizing reconciliation tools to manage financial transactions and regulatory compliance.

- Government and Public Sector: Government entities adopting reconciliation software to meet financial auditing and compliance standards.

- Others: Various other industries implementing reconciliation solutions to enhance financial accuracy and operational efficiency.

By Region

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America is currently at the forefront of the account reconciliation software market, boasting a substantial market share thanks to its early embrace of cutting-edge financial technologies, a robust presence of major industry players, and a regulatory landscape that promotes the adoption of automated financial solutions.

Recent Developments & News

The account reconciliation software sector is experiencing remarkable progress, with leading companies rolling out innovative tools designed to streamline financial management processes. These advancements are centered around the integration of artificial intelligence and machine learning, which help automate data matching and detect anomalies, ultimately boosting both accuracy and efficiency. Moreover, there’s an increasing focus on cloud-based solutions, providing the scalability and flexibility needed to cater to the varied requirements of organizations across different industries.

Key Players

- API Software Limited

- BlackLine Inc.

- Broadridge Financial Solutions Inc.

- Fiserv Inc.

- Intuit Inc.

- Oracle Corporation

- ReconArt Inc.

- Sage Group plc

- SmartStream Technologies Ltd.

- Trintech Inc.

- Xero Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4891&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145Account Reconciliation Software Market: Trends, Growth, and Forecast (2025–2033)